Learn modern money management skills from finance advisor and author Samuel Cannonier.

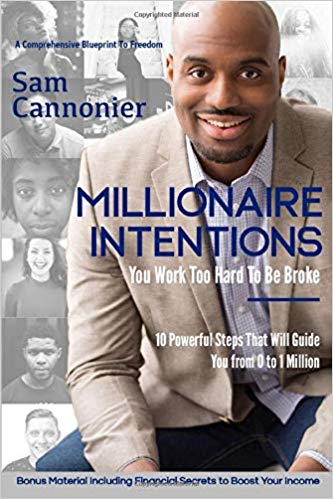

To quote Dave Ramsey, “You must gain control over your money or the lack of it will forever control you.” Don’t feel alone on the confusion island of finances because I’m here to tell you we all struggle with good, consistent financial practices. Lucky for us, I found financial expert Samuel Cannonier to give tips and advice to people of all ages to increase financial literacy. He recently wrote a book titled “Millionaire Intentions”.

Read more about Cannonier in Episode 21 of People You Should Know.

- You recently wrote you a book titled “Millionaire Intentions” (available on Amazon for $19.90) where you share a wealth of knowledge and educate readers on how to go from $0 to $1 million dollars. What was your greatest motivation for writing “Millionaire Intentions”?

Honestly, my motivation came from my personal struggle. I was tired of killing myself with work without anything to show for myself. My life was in shambles, and I read every book possible about finance and used those principles to build wealth. I started to tell everyone I was close to and everyone encouraged me to write a book. Years later, Millionaire Intentions was created.

- What’s the biggest mistakes you see people make when it comes to building a savings account?

Two issues. First, some people believe that you need tons of money to get started. It doesn’t matter how much you have. Start today, if you make $1000 a month save a portion of it (at least 10% which would be $100). Saving a portion consistently builds wealth. Second, we need to save for a purpose. It’s too hard to save if you don’t have an intentional reason to do it. We have too many traps that will discourage us if we don’t have a why connected to the reason why we save. Such as buying a house, car, emergency etc..

- As a financial service and banking expert, what difference do you see between millennials and Generation X when it comes to spending, saving, and making big purchases; such as buying a home?

Great question, I believe most millennials have seen the market fluctuates and the housing market to go down. I believe that based on the struggles of past generations, younger people are aware that building wealth is critical. Also, we know that nothing is guaranteed in regard to employment, so it’s important that you focus on yourself and family.

So some are waiting longer times to make huge transactions.

- What do you enjoy most about being in the finance industry?

Outside of our personal relationship with God and our families, a person’s financial well being is next in line. I know how it feels to struggle, and I have deep compassion for people of need. If I make a small difference, I feel like I’ve done my part.

I’m currently in 3 schools and I have a personal finance curriculum. Teaching our children is part of my legacy and it’s important to me.

- How can someone save for a big purchase (such as a car) when they work a minimum wage job?

I believe people should purchase items based on their financial situation. If someone is working a minimum wage job, they should look at a car within their budget. We should never finance for a new car regardless of income. Cars don’t appreciate, and I’ve seen too many people enslaved themselves into debt for 5-7 years paying a car note. Debt is the enemy of wealth.

Buy a used car that can get you to A to B. My 1st car was 15 years old and it did the job. As my career and lifestyle change, the better my options became available.

- What are the advantages and disadvantages of using online banking?

Mostly positive, I hate budgeting so online banking gives easy access to your financials. The only drawback is that we become over-reliant to them and don’t monitor our transactions ourselves.

- Do you think that owning properties is a good way to generate a second income?

Yes, it’s one of the best ways to invest! Like all investments, you need to be smart about and do your research.

- What’s the best way to purchase a house? Savings, loans, or other sources?

I believe that you should save 20% before buying a house. It makes sense to stay at home or pay rent until you build up enough money. There is nothing wrong with starting off with a small house and work your way up.

- What are the most basic ways that people can improve their credit score?

Stop buying crap! Lol, 1st thing is to check your credit history. You have a 25% chance of having something inaccurate on there. 2) Pay bills before the statement date 3) Make multiple payments 4) Ask your creditors for deletion.

- What financial creed/advice do you live by?

Believe God has the answers to all of your problems, invest in yourself and have faith that you have the ability to work things out. I believe that we all can build wealth and if we can become intentional in the process.

Get your copy of Cannonier’s book to start your road to credit balance!

Purchase your copy of “Millionaire Intentions” by Samuel Cannioner on Amazon today. Organize your financial goals for the next year and kickstart your energy to approve them at the same time.

People You Should Know – Episode 21 featuring Samual Cannonier